Webinar Recap - Tips on Tipping: Part II

Whether you are an experienced employer or just getting started in the restaurant industry, understanding the ins and outs of wage and hour requirements can be a challenge. In this educational webinar, Larry Stine and Elizabeth “Betsy” Dorminey of Wimberly, Lawson, Steckel, Schneider, & Stine P.C. share their expertise on wage and hour regulations, notification requirements, record-keeping, deductions, overtime, and dual work in Tips on Tipping: Part II.

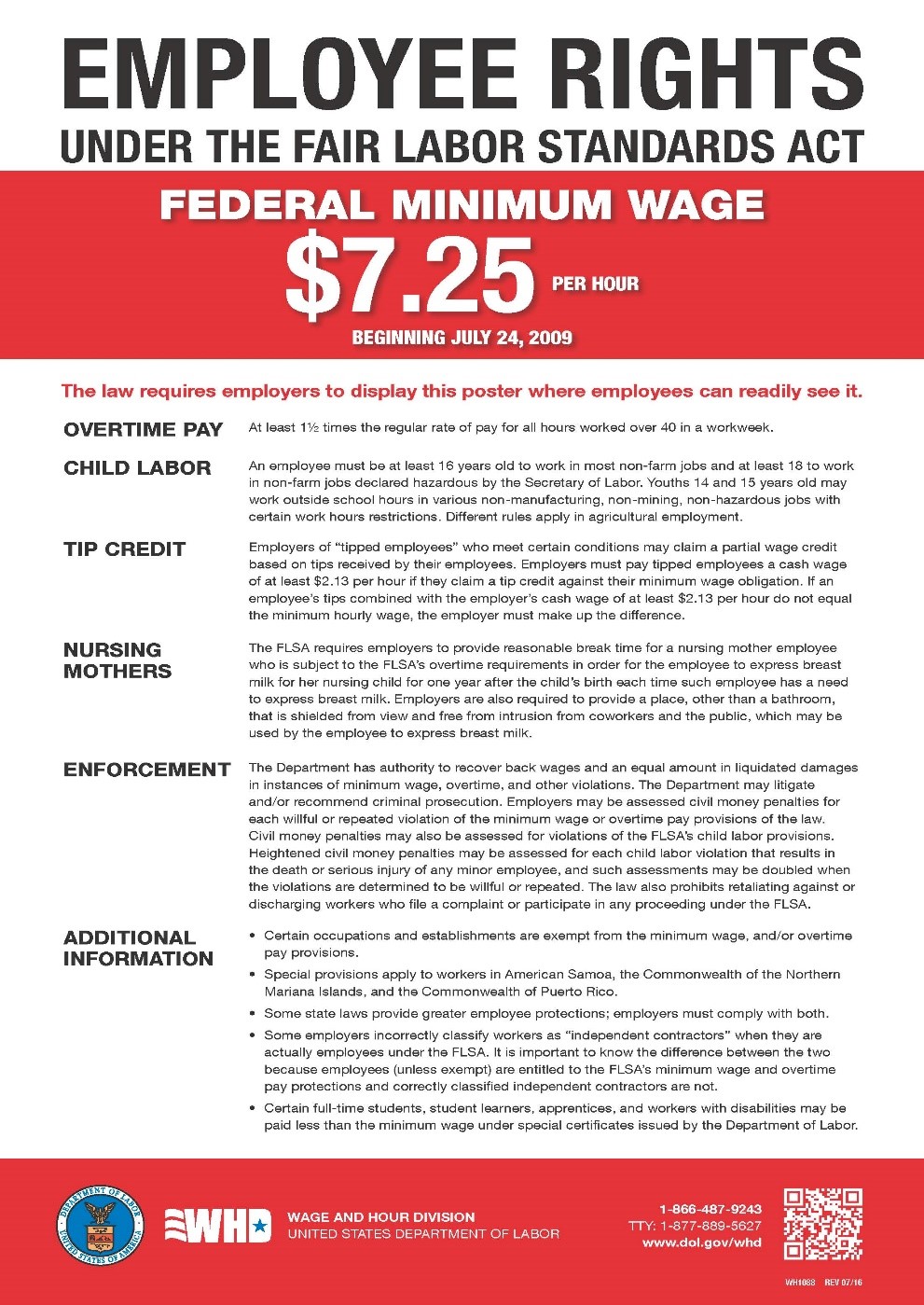

Post It: Use detailed posters that comply with mandated notice requirements, including detailed explanations of any tip pool arrangements or overtime policies. A sample Fair Labor Standards Act (FSLA) poster is shown below:

Deduction v. Discipline: Sometimes, employees will accidentally damage restaurant equipment or mis-ring orders, incurring cost to your business. If they are a tipped employee, you cannot deduct this cost from their tips because they are considered minimum wage workers at $2.13/hr. Instead, you may perform disciplinary action or assign the worker to another position.

Keep a Record: Maintain a record of hours worked, including overtime hours, and report tips as taxable income. If you employ children under the age of 18, ensure that their schedules and job responsibilities are in compliance with the Georgia Department of Labor’s Child Labor Work Hour Restrictions.

What to Expect in Times of Trouble: Should the U.S. Department of Labor’s Wage and Hour Division arrive at your restaurant to investigate a potential violation, it is important to prepare a plan with guidance from a trusted wage and hour attorney, who may be able to negotiate payment plans, review records, and more on your behalf.

Overtime + Dual Rates: What if I have an employee that participates in tipped AND hourly work? How do I calculate overtime for tipped employees? Can I provide wage advances? For the answer to these questions and more, click below to watch the full recording:

Tips on Tipping: Part II – Watch the Recording.

If you missed Part I of the Tips on Tipping Webinar Series, you can watch it on demand below:

Tips on Tipping: Part I - Watch The Recording.

This information is provided for educational purposes only. Please consult your trusted legal and financial representation for advice. Any questions regarding this webinar can be directed to:

Larry Stine & Elizabeth “Betsy” Dorminey

Wimberly, Lawson, Steckel, Schneider & Stine, P.C.

Lenox Towers – Suite 400

3400 Peachtree Road, N.E. Atlanta, Georgia 30326

www.wimlaw.com

404.365.0900

las@wimlaw.com